You might think it’s unrealistic to invest as a student. When we’re young, we have lots of time and not much finances. As we get older, we often have more money and responsibilities and less time. But thanks to modern technologies, investing in 2026 is multifaceted and more accessible. You don’t need thousands in your bank account or keep the actual physical stock certificates.

The rising popularity of investing can partly be explained by the COVID-19 pandemic, during which many people lost their jobs and didn’t have alternative incomes. Putting money into something turned out to be a very beneficial passive income; however, it requires some experience, patience, and analysis skills. That is why we suggest trying your hand at investing during your student years.

In this article, we’ll debunk the myth that you need a lot of money to begin investing and provide a guide on how to get to it as a student.

📖 Quick Investing Glossary

- Asset. Tangible or intangible items obtained for producing additional income or held for speculation in anticipation of a future increase in value (Extension Foundation).

- Asset class. Different types of investments that behave similarly and are subject to most of the same market forces. There are 3 main asset classes: stocks, bonds, and cash equivalents (The Free Dictionary).

- Return on investment (ROI). The amount of profit, before tax and after depreciation, from an investment made, usually expressed as a percentage of the original total cost invested (Dictionary.com).

- Principal. The original sum committed to the purchase of assets, independent of any earnings or interest (Investopedia).

- Compound interest. Interest that is generated both on an original sum of money and on interest that has previously been added to the sum (Collins Dictionary).

- Dividend. A part of the company’s profit that is paid to the people who own shares in it (Cambridge Dictionary).

- Investment portfolio. The whole range of financial investments belonging to an individual investor or a financial organization (Collins Dictionary).

- Diversification. The spreading of your investments both among and within different asset classes (FINRA).

- Risk. The degree of uncertainty and/or possible financial loss inherent in an investment decision (Investor.gov).

- Index. An index tracks the performance of a group of preselected investments, such as stocks (NerdWallet).

- Volatility. The frequency of price changes and its degree (TheStreet).

🎓 Investing for College Students: Common Questions

Why Should College Students Invest?

Investing is one of the tools that can assist you in gaining financial independence and, more importantly, give you valuable experience. Money management is a core life skill; the more experience you get, the better.

Some other benefits of investing as a student are as follows:

- It improves your financial habits. Before you graduate and build your career, you can train valuable skills such as analytical thinking, budget planning, and decision-making.

- It helps pay off student loan debt. By practicing investing at college, you can prepare yourself for paying off your student loans and ensure you never get behind on payments.

- It turns minor savings into major profits. For example, according to The College Investor, if you start investing $6 per day at age 18, you will reach $1 million by 62.

How Much Money Do You Need to Start Investing?

Investing your savings to earn more sounds great, but most students don’t have a spare $1000 lying around. It is a total misconception that only with a lot of money you can start investing, and it demotivates many young people.

Good news – you can start investing for as little as $1 with the help of commission-free trading platforms. To calculate the suitable amount of money to put up, consider your budget, monthly expenses, emergency money, and other savings. You might end up investing $10 or $2,000 a month, but the sum should be sustainable so that you can commit to it every single month.

Should You Invest if You Have a Student Loan?

There’s no universal answer to this question. While certain professionals recommend getting rid of debt first, others claim that it can actually help you.

A general rule is to check if your student loan interest is lower than the average return on investment. For instance, if a plausible return on assets is 6% per year and the interest rates for your student loan exceed it, it’s better to pay them off first. However, if your student loan interest rates are under 6%, you might try putting extra money into investing.

💰 Types of Investments for Beginners

Let’s see which investment format might work for you.

Certificates of Deposit

A certificate of deposit (CD) is an account that withholds a particular amount of money for a certain period, six months, for example. In exchange, the bank pays interest. A CD is one of the secure ways, suitable for students.

Another benefit is that CDs offer flexible accounts for you to choose the suitable amount of money to invest and the time frame. As of June 2024, the average rate for a one-year CD is 1.80%.

Bonds

Buying a bond means lending your finances to a government or a company for a set period, from about a year to as long as 30 years, and receiving interest in return. Most bonds have fixed interest rates, but some might have fluctuating ones. On the bond’s due date, you’ll get back the money you invested plus the interest earned.

One of the main advantages of bonds for students is that they provide a predictable income source. Usually, bonds pay interest twice a year.

Stocks

When you buy a stock, you purchase a small piece of a firm, a share. If you buy stocks in a company that goes up in value, its stocks also increase in value. However, in the worst-case scenario, the company may go bankrupt, devaluing your stock.

There are 2 ways you can profit from stocks. Firstly, sell the stock for more than you paid and have a capital gain. Secondly, some companies pay shareholders dividends in cash quarterly. Buying stocks is an excellent chance for students to earn money and improve discipline and patience.

Mutual Funds

A mutual fund is a company that collects money from many sources and puts it in stocks, bonds, and short-term debt. Mutual funds are a good opportunity for a student to start investing, and here is why. When you buy mutual funds, you rely on professionals to manage your money in multiple assets at no extra cost. Like with stocks, you can get regular dividend payments or sell your fund when it increases in value.

A mutual fund is affordable and guarantees professional assistance from fund managers.

Target-Date Funds

Target date funds (TDFs) mix various types of bonds, stocks, and other assets into a single portfolio for your goals. TDFs are commonly used for retirement savings but can be adjusted to other objectives. As you get closer to your set date, the fund shifts from a mix of stock investments to lower-risk options.

TDFs are a go-to if you have long-term financial goals and want professionals to take care of your investments.

Index Funds

Index funds are very similar to mutual funds. The primary difference is that instead of employing an expert to build your portfolio of investments, you invest in all the stocks of a particular market index. For instance, the S&P 500 is a market index containing stocks of the 500 largest companies in the US.

Investing in index funds is another option for young people because it is relatively low risk. Index funds have minimum investment requirements, meaning you can begin investing for less than $100.

Exchange-Traded Funds

Exchange-traded funds (ETFs) are quite similar to mutual funds because when you purchase ETFs, you’re also investing in the stocks of a specific market index. The main distinction is that you can buy or sell ETFs like regular stocks.

Moreover, ETFs are considered more tax-efficient than mutual funds and more transparent. You can Google and see price activity for a specific ETF. You should consider buying ETFs if you’re genuinely interested in investing and are ready to do some research.

🪙 Other Investment Types to Consider

Investing comes in many forms: cryptocurrencies, real estate, precious metals, and collectibles, which are also things you can put your money in. They have peculiar complexities and require careful analysis and strategic decision-making.

Cryptocurrencies

Cryptocurrency is a digital asset with which you can buy or trade goods and services for profit. Due to cryptographic techniques, people can utilize digital currencies without assistance from the government or any financial institutions. When the demand for a particular cryptocurrency goes up, so does its value, which attracts more investors. However, since cryptocurrencies are a high-risk investment, experts claim they shouldn’t make up more than 10% of your portfolio.

Top cryptocurrencies that could be worthy of investment include Chainlink ($6.92), Avalanche ($16.96), Binance Coin ($333.39), and Bitcoin ($28,412.93). Since some are very expensive, you can purchase a small part of one. For example, 0.000001 Bitcoin is worth 0.26 USD as of May 23, 2023.

Real Estate

Generally, students cannot anyhow afford a property. But it is still possible to invest in real estate and profit from it. The two options are ETFs and real estate investment trusts (REITs). We’ve already learned about ETFs; here’s more on REITs. Since REITs trade on public exchanges, they are easy to buy and sell. However, there’s a significant disadvantage: most REIT dividends are taxed as regular income.

Collectibles

Collectibles are items that cost far more than they were initially sold for because of their rarity or popularity. Examples include antiques, toys, coins, comic books, stamps, fine art, and limited-edition sneakers.

Investing in collectibles may expand your portfolio while owning things you admire. However, there are no guarantees that your collectibles will rise in price. Moreover, the price is often determined by the condition of your collectible, making this an unreliable investment.

Precious Metals

Another way to invest outside the stock market is to buy precious metals such as gold, silver, and platinum. However, like other speculative investments, they can provide high returns or losses. If you don’t want to buy physical quantities of precious metals, you can invest in them through the stock market or ETFs.

As long as you don’t over-invest in precious metals, you can use them as an insurance policy for your portfolio since precious metals tend to maintain their value.

💻 Investment Options for Students

The next important step is to pick a platform or tool that best corresponds to your financial goals. Here are the top 4 recommendations for beginner investors.

Investment Option #1

Online Brokerage Accounts:

How It Works

A brokerage account is quite similar to a normal bank account in that you can transfer money in and out. With a brokerage account, you can purchase and sell stocks, bonds, and mutual funds.

Pros & Cons

➕ You can open an online brokerage account quickly and for free to get a hands-on investment experience.

➖ A brokerage account is taxable, so you need to set aside some money.

For Whom

This is an excellent option for beginner investors who are ready to spend some effort on research to ensure they make conscious choices. This option allows you to tailor your investment portfolio to your financial needs.

Investment Option #2

Robo-Advisors:

How It Works

Robo-advisor services automatically balance your investment portfolio. You can invest $200 or $2,000 without worrying about investment research or picking individual stocks. Instead, the algorithm-based robo-advisors will tax-optimize your portfolio.

Pros & Cons

➕ Robo-advisors are great for student investors due to their affordability. Start investing as little as $1 on some platforms for 0.15% per year in fees.

➖ A robo-advisor lacks some customization and may not be the perfect choice if you want to work on your financial skills. Be cautious about the cost of extra services since they can be pricey.

For Whom

Robo-advisors are ideal for fans of passive investment strategies or long-term investors who don’t want to research the better options.

Investing Option #3

Micro-Investing Platforms

How It Works

Micro-investing platforms allow inexperienced investors to save small sums of money regularly. They don’t have any brokerage account minimums and motivate individuals to invest even if they have limited income.

Pros & Cons

➕ Micro-investing apps make it easy to start investing at a low cost.

➖ However, they offer small returns and little flexibility when deciding on your investments.

For Whom

Micro-investing apps might be useful for newcomer investors and students who seek to avoid complex services and processes.

Investing Option #4

Individual Retirement Accounts (IRA):

How It Works

An IRA allows you to save finances for retirement in a tax-advantaged way. In a traditional IRA account, you can invest in various financial assets: stocks, bonds, and mutual funds. At the same time, you can diversify your portfolio through a self-directed IRA and invest in real estate and precious metals.

Pros & Cons

➕ IRAs are very accessible, and you can manage your investments independently or with the help of a financial expert.

➖ The disadvantage of having an IRA is that you’ll have to wait to get your money out because most IRA plans will penalize you for making early withdrawals.

For Whom

Opening an IRA can benefit students who don’t work for an employer that offers a retirement investment plan.

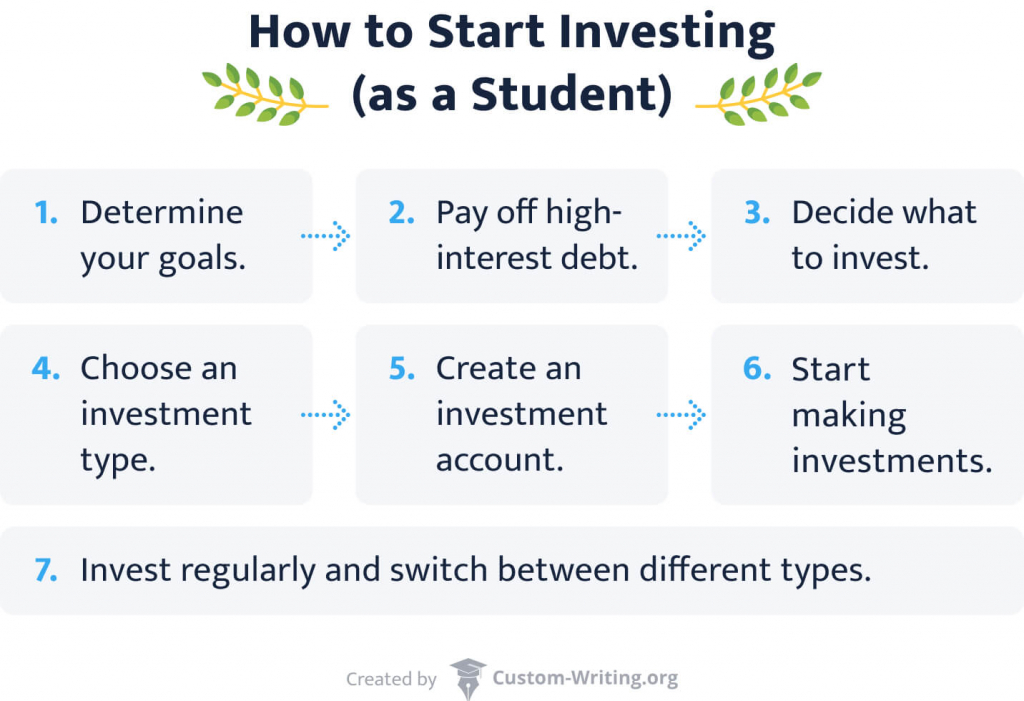

🧑💻 How to Start Investing as a College Student: Step by Step

If you’re a college student willing to start investing, don’t skip our guide.

1. Identify Your Goals and Current Situation

First thing first, outline clear objectives. Your investment strategy will significantly depend on your short and long-term goals.

Examples of short-term financial goals vary from paying your student debt to taking a vacation. These are expenses you will have in the next one to five years, so you don’t want to invest in anything risky.

As for long-term financial goals, it might be purchasing an apartment, retirement savings, or wedding expenses. Since long-term investments usually have a timeline of five years or more, you can afford a bit more with them.

2. Pay Off High-Interest Debt

No one enjoys paying off credit cards, student loans, or any other debt. It might be frustrating and leaves one with no money for daily expenses. Nevertheless, there is no way you can start investing efficiently without paying off your debts first.

With no debt repayments, you have more opportunities to invest and can claim higher returns. Closing your debts will take a weight off your shoulders, motivating you to make smart investment choices.

3. Decide How Much to Invest

The sum you can invest depends on many factors (financial situation, investment goal, time frame, etc.). The winning strategy is to be consistent with your savings and regularly set aside a given amount. Remember that you can start small, even just $5 to $10 a week. This way, you can quickly generate surprising gains without breaking your budget. A regular investment schedule will also help you develop that investor mindset and boost your financial skills.

4. Decide on an Investment Type

Once you start building your investment strategy, revise your financial goals again. If your primary goal is retirement savings, almost all your assets can be in stocks. Since it might be complex for a beginner to pick specific stocks, you might want to invest in mutual or index funds.

For short-term goals, we recommend keeping your money safe and building a low-risk investment portfolio. If you can’t or don’t want to decide, you can always open an investment account through a robo-advisor.

5. Open an Investment Account

The next fundamental step is selecting the right type of investment account. Firstly, you need to define what kind of investor you wish to be. While some investors find it efficient to monitor finances daily, others choose a more passive approach.

Besides, you should consider fees and minimum balance requirements. It’s best to create a table to compare multiple options and choose the best-matching one.

6. Start Making Investments

Here comes the most thrilling moment: your first investment. The safest place to start is a low-cost index fund, like the S&P 500 index. It is a cheap way to make your stock portfolio diverse. However, it is also possible to invest in a specific organization. Just be sure to do sufficient research.

7. Invest Regularly and Diversify

When building your investment portfolio, you shouldn’t put all your eggs in one basket. Instead, diversify so that if one investment drops in value, another might grow. Experts recommend ensuring you have investments across a wide variety of sectors as well as risk levels. A complex and diverse portfolio might include a mix of stocks, bonds, index funds, and alternative assets.

To determine how to allocate your money among multiple assets, you might get advice from an investment expert, but you also need to do your own research.

🙅 Beginner Investment Mistakes to Avoid

Investment can be risky, and some things are beyond our responsibility. Nevertheless, there are common mistakes inexperienced investors make.

❌ Investing Before You’re Ready

First, you shouldn’t start investing until you’re financially and mentally stable. To build your financial cushion, you must create a budget, pay off high-interest debts, and set aside emergency reserves. A general recommendation is to have an emergency fund that can cover your daily necessities for three to six months.

❌ Not Doing Research Before Investing

If you want to invest in a company, simply choosing a famous one like Amazon or Apple is a mistake. The cost of stocks in these corporations is too high for most beginners. To pick the best stock, you need to investigate. There’s plenty of information available online, and you can also consult a financial advisor or download a micro-investing app.

❌ Looking for Short-Term Gains

Nearly 56% of experienced investors say that looking for fast gains is the most typical problem at the start. Purchasing and selling stocks soon might be tempting, but it can also be dangerous. Doing this can put you at risk of losing all your savings. Instead, create a safe investment strategy based on your goals and timeline.

❌ Making Emotional Decisions

Many new investors make choices based on excitement and even greed, without paying attention to how undervalued or overvalued the stocks are. Investors also sell in a panic if the overall market drops, not appreciating how often the market fluctuates. When investing, it’s essential to control yourself and be as rational as you can.

❌ Trying to Time the Market

Another spread mistake is getting in and out of the market based on your predictions. It is impossible to identify the market’s best or worst days in advance. In most cases, attempting to time the market will only kill your returns.

❌ Not Diversifying Enough

Many newcomers underestimate the power of diversifying their portfolios. Imagine you own twenty different stocks. If ten of those are tech corporations and ten are energy companies, you’re not diversified. A sudden drop in the tech market could change the fortunes of half your portfolio. On the contrary, try to invest in various industries and countries, too.

❌ Paying Too Much in Commissions

Once you start investing, pay attention to how much money you spend on trading commissions. These are the fees your brokerage charges for each operation. If you spend too much money on these fees, they will rob you in the future. The general recommendation here is to aim to pay no more than about 2% of the value of your trade.

🔮 Top 10 Investment Tips for College Students

To help you get the most out of your investments, we collected the top 10 tips from financial experts and more experienced investors.

📱 Be critical of the investment apps you use.

Many investment apps have simple interfaces and cool design features that might distract you. These apps can stimulate you to put more of your money and have a tangible impact on your financial well-being.

🪙 Be careful with investing in ‘crypto’ and other digital assets.

If you consider investing in digital assets, remember the risks, such as a lack of investor protection and transparency.

📈 Analyze tendencies.

There are certain investor tendencies that are best to avoid, such as holding on to losing investments too long and selling winning investments too quickly.

🔐 Protect your online investment accounts.

You should always take measures to secure your financial information. Use strong passwords, activate two-step authentication, and turn on account activity alerts.

🙋 Ask questions.

Don’t be afraid to seek professional help with your investment portfolio. Everybody starts somewhere!

👩💻 Monitor your investment performance.

Remember to compare your returns to an index of similar investments and the commissions you’re paying to what other investment professionals charge.

🧠 Don’t forget to invest in yourself.

Don’t put all your energy and time into building a strong portfolio. First and foremost, take care of your studies, social life, and general well-being.

📚 Build your knowledge.

Investigate reputable resources to learn more about investment strategies and market trends.

📜 Start with a certificate of deposit.

It’s better to start investing in a safe option, such as a certificate of deposit, to grow your savings and reduce risks.

⚡ Remember the risks.

Be ready that the stock market fluctuates sometimes, and investments may not increase in value consistently or quickly.

🔎 Conclusion & Bonus Resources for Beginner Investors

Your college years can be an excellent time to begin exploring your investment opportunities. Surprisingly, investing doesn’t require you to have a ton of money, but it does demand you do your research though. Luckily, there are plenty of trustworthy sources from which to learn about different types of investments and platforms.

Remember that there’s no one right way to invest. How to invest your funds is a personal decision you make based on your financial situation and goals. Be sure to explore your options and your risk levels before investing your money.

Check out these resources to help you successfully navigate the world of investment.

⚠️ Disclaimer

The information provided aims to help you learn investment basics and share some personal opinions. Before making any financial decisions, it is recommended to contact a professional financial advisor.

🔗 References

- Fundamentals of Investing: University of Virginia

- Investing: Massachusetts Institute of Technology

- Saving and Investing for Students: US Securities and Exchange Commission

- Best Investing Apps for College Students: Benzinga

- Should You Pay Off Student Loans or Invest?: NerdWallet

- Saving and Investing: University of Oregon

- Investing: Financial Wellness @ Penn

- 10 Retirement and Investing Tips for Graduate Students: Columbia University

- Making Smart Investments: A Beginner’s Guide: Harvard Business Review

- Best Investing Podcasts for Beginners: Morningstar

- A Beginner’s Guide to Investing in the Stock Market: Fortune

- Best Investment Apps for Beginners in May 2025: Business Insider

- Is Gold a Good Investment for Beginners?: CBS News

- Investing for Beginners: Syracuse University

- The 5 Biggest Investing Mistakes Beginners Need to Avoid: Money

- 20 Worst Mistakes Rookie Investors Make: GOBankingRates

![How to Organize a Successful Study Group [GUIDE]](https://custom-writing.org/blog/wp-content/uploads/2023/04/doing-homework-together-1-284x153.jpg)

![The Scaffolding Technique in Education: Benefits & Examples [Is It Really Useful?]](https://custom-writing.org/blog/wp-content/uploads/2023/03/business-women-signature-document-1-284x153.jpg)