Introduction

The government of the US plays a significant role in the American economy, which is the backbone of the country’s success and also has a role in the control of firms in the industry so as to check on the supply and pricing of commodities. It is responsible for the management of all the economic activities in-country.

The government employs two important implements in realizing these objectives: a fiscal policy, that determines how much tax should be done on industries, individuals, or any other businesses in the country.

It is also used to set and check on the appropriate spending levels of the country; monetary policy finds its applicability in the supply of money within the nation.

Both of these policies work together or rather in a kind of mix in order to allow for sustained growth and stabilization of prices. The government is therefore faced with the challenge of getting a fair mix of both monetary and fiscal regulation, which would bring about the targeted results.

Friedman (2001) This should be done wisely since the poor combination of the two leads to economic depression or recession, which can easily bring down the nation.

This task is not, and there have been failures every now and then, which are addressed appropriately. The main objective of monetary policy, however, is to ensure that there is low inflation and a stable expanded sustained economic growth, while that of fiscal policy is mainly to control budget deficits.

Fiscal policy

It was noted that the fiscal policy is responsible for the control of taxation in the country as well as setting the most appropriate levels of spending of the state towards its citizens or towards other programs which include donations, giving loans and development projects in other countries so as to eliminate or control budget deficits.

When there is cash- flow deficit in the country, fiscal policy is applied to address the issue. Public spending is reduced on matters such as discretionary programs and national defense. The implication of this would be reduced inflation expectations, which would lead to expanded net interest outlays.

In case there is a budget deficit, tax receipts can be increased by hikes in legislated tax or can be boosted by robust growth in the economy or related capital gains. Budget surpluses or deficits measures such as increasing or decreasing legislative taxes or withdrawal of net interest out can not be used as bases for performing macroeconomy policies or for predicting the outcomes of the economy since they are unreliable.

These uncertainties of the budget deficit form a poor foundation for laying macroeconomic stabilization as well as an improper way of determining the appropriate monetary/fiscal mix.

Elimination of budget deficit, which is fiscal policy, has a wide range of financial and economic outcomes, among them an increase in net government saving and decreasing the deficits of the current accounts. Generally, the contractional fiscal policy by the government is used to control budget deficits by increasing taxes and reduce spending (James, 2004).

Monetary policy

Monetary policy, as noted earlier, is mainly concerned with the supply of money. In order to tackle the issue of price stability in line with economic sustainability and growth than an unquestionable knowledge on the role of monetary policy in the process of inflation is required. Inflation is realized when too much money is let to circulate into the economy.

This is because it increases the relative demand for products, which is in excess of the present production capacity. It is not realized due to unemployment or by economic growth as perceived by many people. This is evidenced by considering the curve of unemployment rate against changes in demand or supply of products.

At present, inflation has reduced due to hiking economic growth and due to much availability of employment for the citizens and also the limited opportunities for business to raise prices.

Monetary policy can, however, be used to influence fiscal policy on deficit reduction, for example, delaying before lowering interest rates. This would lead to a decline in real money balances though the objective would be reached. This would also lead to an economic recession (James, 2004).

Fiscal policy is superior to monetary policy, although the latter can be used to influence the effects of the former. Taxation provides the money available for spending by the government, and therefore, once the fiscal policy is applied in the economy, the monetary policy which controls the supply of money automatically follows suit. An example of a practical application of in the US in recent years is in the control of deficits. This is illustrated as shown below:

Returning Of Deficits through Fiscal Reform

The United States government has undergone terrible budget deficits in recent times. This deficit is so large that it has overshadowed the previous budget surpluses by far. This is because the government of the US has been spending heavily on military projects. These projects are consuming the earlier saving making the country under an economic recession.

This has not affected the federal government’s budget but also the state and the local governments. As a result of this, the government is seeking loans from other countries so that it can stabilize its economy before it leads to major economic problems such as inflation, crime, and unemployment Friedman (2001).

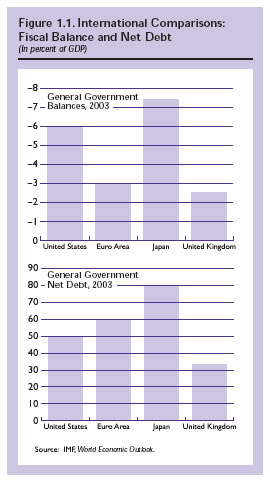

Due to this, the deficit of the general government is ranked among the developed nations and the third world countries. The country’s borrowing trends have made its debt levels to look similar to those of major industrial countries. The table below indicates the differences between fiscal budgets of the US with other industrialized countries.

The fiscal policies have certainly been of great valuable importance as a remedy to the recovery of the budget deficit. With the budget projections showing huge fiscal deficits in this decade and the decades to come due to strategies such as decreasing of taxies, huge expenses security and defense details, and the stimulation of economic recovery, then fiscal policies must be applied to control inflation.

The disappearance of fiscal excesses has left the US budget prone to collapse with the retirement workers in the industry, which is set to start at the end of this decade with the effect of pressuring Medicare and social security strategies. These reforms are made possible by the fact that the country had earlier budget deficits because they give a grace period for the increment in taxes, reduction in government spending.

The Costs and Significance of Tax Reduction And Deficits

There has been a great disparity about the fiscal policies and especially tax reduction, and how it has revived the unresolved issue of the extent of fiscal reforms in handling deficits problems. Investment from the private sector, economic inducements, and tax evasion can greatly increase the supply of products to the members of the society. The current government is working hard to help solve the issue of budget deficits.

Conclusion

Reliability is important in ensuring economic growth control of the country. The government must be able to come up with the appropriate monetary and fiscal regulation policies mix since the two policies go together. However, emphasis so is on fiscal policies that control the amount available for spending as well as the tax that should be levied from the subjects of the government.

This is because fiscal policies address the issue of inflation, which is the core of the whole macroeconomics. The stabilizing issue of the two policies is to adjust the monetary to the fiscal policy. The discussion so far implies that the fiscal problem in the US is very large, but it can still be undertaken.

Further research has shown that it is difficult to obtain the correct monetary and fiscal appropriate name. In recent years, however, there is a progression in the use of monetary policy as the government tries to achieve its goals, which are low inflation, which is important for sustained economic development.

References

“Federal Reserve Act”2003. Federal Reserve Board. May 14, 2003.

Forder, James. (2004). Credibility in Context: Do Central Bankers and Economists Interpret the Term Differently?”

Friedman, B. M. (2001). Monetary Policy,” International Encyclopedia of the Social & Behavioral Sciences.

Milton, Friedman. (1990). A Program for Monetary Stability. Fordham University Press.