The pace at which the US Federal Reserve has been applying mandatory cuts on bonds has raised different reactions from the business community. Opinions have been divided on whether to allow the economy to recover or decrease bond purchases at the present pace within the year. The unpredicted economic performance has made business economists appear in this great dilemma of tapering the US Federal Reserve.

The National Association for Business Economics (NABE), after conducting its survey among 230 members of the business community, decided to disclose the clear division within the members over the pace at which the US Federal Reserve has been tapering (“US economists divided over pace of US Federal Reserve tapering” n.pag). Even with the creation of a thick reserve cushion during recent years, the Federal tapering program has caused agitation among members of the NABE.

According to the Federal Reserve Governor, Ben Bernanke, winding-up of the money printing firms is one way of ensuring that the fiscal deficit remains within the government’s projections (Kirkire par. 5). Even as global markets feel the heat of tapering, there is uncertainty among the NABE members on when the tapering will end.

Even though the Fed cut in bond purchases by $10 billion represented a small cumulative percentage, the continuous cuts have hiked the rates of mortgages. The 410 billion cuts in bond purchases reduced the bond-buying program from $75 to $65 billion between January and February. The reduction in the bond-buying program is taking place after the purchase program succeeded in stimulating the economy since September 2012 (Kurtz par. 6).

There had been a drastic decline in job additions from 205,000 to 74,000 vacancies in December 2013 (Kurtz par. 8). The current disagreement over the move by the Fed to end its accommodative stance in a gradual manner indicates the availability of varied approaches that the central bank can apply to resuscitate the situation.

The increase in inflation rate prompted the Fed to adjust its basic short-term interest rate beyond the present zero levels. Respondents held different opinions on the fiscal policy as well as the economic effects of the Affordable Care Act. The different thought aired included no effect on the economy, economic boost, and negative impact on the US economy. The chief North American economist for BNP Paribas, Julia Coronado, holds that global market wobbles did not directly affect the policies of the Federal Reserve.

For instance, in the fourth quarter of the 2013 fiscal year, the United States’ GDP grew at 3-4% rate (Kirkire par. 2). The impacts of the massive stimulus programs at the central bank are the major worry of Bernanke’s critics. On the other hand, having guided the country through one of the worst global economic meltdowns in 2008/2009, President George W. Bush’s appointee has received credit and recognition for preventing deeper downturns.

The insertion of liquidity into the United States’ banking system, popularly known as quantitative easing, traces its origin from the mortgage crisis of 2008. The buying of mortgage-backed securities opened the avenue for unsecured borrowing. With numerous lessons learned from the 2008 global depression, banks have increased their reserves by maintaining over 34 times the value as at the past recession. Banks have also reduced their appetite for taking huge risks, in terms of mortgages.

The intention of tapering is to determine whether emerging markets can grow their economies without the support of established economies (“US economists divided over pace of US Federal Reserve tapering” n.pag). Notably, the quantitative easing (QE) program has also supported the performance of financial markets in the past, thus enhancing the sustainability of the systems.

With the global rate of inflation taking a positive move, the tapering process should not be a surprise to business economists; the continuity of the program has to rely on the incoming economic data. Tightening the monetary policy requires a deeper understanding of economic recovery as well as changes in inflation (Kirkire par. 4).

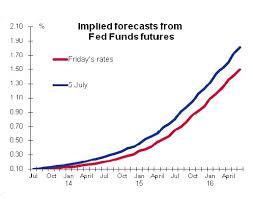

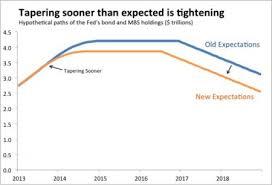

The graphs below indicate the trends of the global market before and after the introduction of tapering by the Fed. They are obtained from the CNN Money website.

Works Cited

Kirkire, Sandesh. Little reason to fear US Fed’s tapering programme. N.p., 2014. Web.

Kurtz, Annalyn. Federal Reserve continues taper as Bernanke’s term ends. N.p., 2014. Web.

“US economists divided over pace of US Federal Reserve tapering.” The Economic Times [Washington] 2014: n. pag. Web.