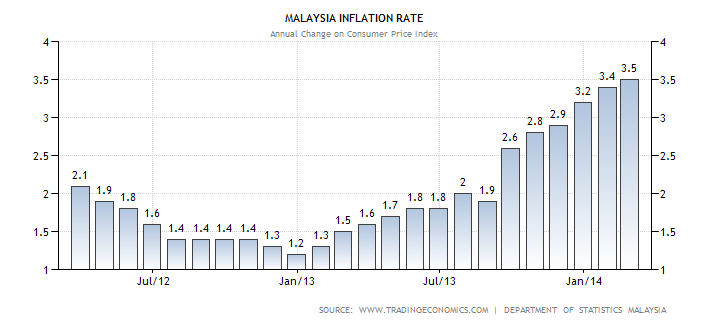

The move by Prime Minister Najib Razak’s government to apply cuts on subsidies in 2013 to reduce Malaysia’s fiscal deficit and high debt burden is part of the reason for the faster increase in prices of essential commodities. So high was the inflation that the consumer price index surpassed the 3.1% December projection by Reuters poll; the index augmented from 2.9% in November to 3.2% in December (“Malaysia inflation jumps as the government feels the heat over living costs” n.pag).

Clearly, the drastic rise in the inflation rate had exacerbated political headaches in the Southeast Asian nation, given that this was the highest peak since November 2011. Again, Malaysia’s consumer index a year ago, that is, December 2012, was at 1.2%. Consumers are always the ones who bear the effects of inflation, as prices of products and services hike to cut-on the augmented inflation rate; this increases the living cost.

Taking a comparison to the 2008/2009 global meltdown, the Malaysian inflation does not only raises the prices of staples like meat and vegetables but also increases the prices of petroleum products and puts pressure on the central bank to adjust the interest rates.

Faster inflation weakens a country’s currency. The need to increase the interest rates in Malaysia is evident in the weak performance of ringgit against the dollar over the past seven months into March 2014; during this period, the ringgit has been down 1.5%. With an expectation of an increase in basis points to a value between 25 and 50, economists are right to argue that the government is under pressure to address the situation speedily (“Malaysia inflation jumps as the government feels the heat over living costs” n.pag).

The Prime Minister has to act before the prices of properties and levels of household debt soar further. Malaysia’s economic situation requires solidarity approach even from the United Malays National Organisation (UMNO), which has been a rival clique within Najib’s party. Even though a bright global economy can fuel the country’s export division to help it grow its economy beyond the anticipated 4.5-5.0%, the government should put in place economic strategies that can assist in easing the pressure on prices of staple commodities.

Even with the government’s move to form a special cabinet committee to warn local markets against increasing the prices of their products, the prices have kept increasing. To tackle the cost of living effectively, the government should ensure that the price of petrol is within reach of consumers, as transportation costs have to be included when selling goods.

With high consumer debt at around 83% of the GDP and escalating prices of houses in key urban centers, the Malaysian economic classes are likely to move down the socioeconomic ladder due to the high cost of living.

With economists like Nor Zahidi Alias of the Malaysian Rating Corporation and Rahul Bajoria of Barclays Capital in Singapore holding that inflation is likely to be hotter from mid-2014, the government should address the factors for the weakening of the ringgit currency to prevent the central bank from tightening the monetary policy (Ng n.pag).

A supplementary reduction in subsidies on essential products like petrol and the expected implementation of a 6% consumption tax by the commencement of 2015 are indicators of non-stop inflation in the Southeast Asian nation. The moves by the government are the reasons for the lack of improvements in the property and food markets. Basing the argument on the government’s inappropriate moves to address the high living cost, the 3.5% inflation rate in February 2014 is likely to rise in 2015.

According to the Department of Statistics Malaysia, food and non-alcoholic beverages forms a huge percentage of essential components in the consumer price index by 30% of total weight, followed by water, housing, gas, and electricity at 23%. From the released report by the Department of Statistics, the government ought to institute regulatory efficiencies and plans that directly address the most affected segments.

Even though Malaysia performs comparatively well in its ease of doing business, the 29.5 million citizens expect to see a reduction in the cost of living. With over two-thirds of Malaysian’s earning below 5,000 ringgits, addressing the inflation will have to hurt everybody (Malaysia Inflation Rate par. 2). Apart from using interest rates as a macroeconomic tool to keep inflation below 3%, the Malaysian government should focus on creating jobs.

A renowned economist, Professor Joseph Stiglitz, held that increasing the interest rates raises a country’s exchange rate, thus reducing the competitive strength of its goods and services. As a result, imports become expensive and flood the market. This leads to job losses, which is not the top solution to addressing inflation. While the government can try to put necessary measures to solve the inflation menace, external factors like high prices of global oil and food are beyond the country’s control.

Inflation has been a global problem. Countries should come together to address these economic problems since economies of nations depend on each other. For instance, changes in the United States’ currency, the dollar, affect the value of other nations’ currencies. Apart from addressing the internal factors, economic giants in the globe should come together to harmonize the global food and oil prices, as they are beyond the control of individual nations.

Works Cited

“Malaysia inflation jumps as government feels heat over living costs.” Malaysia Mail Online [Kuala Lumpur] 2014: n. pag. Web.

Malaysia Inflation Rate. Web.

Ng, Jason. “Rising Inflation in Malaysia Turns Up the Heat on Central Bank.” The Wall Street Journal [Washington] 2014: n. pag. Web.