Introduction

In many modern societies, getting rich is the major goal pursued by every member. In spite of this, very few people understand the key steps that should be followed to achieve the objective. A number of factors must be brought together for one to become rich and successful (Dennis 40). They include luck, working intelligently, and patience.

However, it is important to note that good luck is not a guarantee for success in life. As a result, one should make informed and smart decisions to exploit the opportunities available to them. Generally, the road to triumph is not an easy one. In light of this, it is apparent that perseverance and gathering the right information are key requirements as far as wealth is concerned.

In this paper, the author will analyze a number of issues related to economic success in the 21st century. The review will be conducted from the perspective of 3 books in this field. The 3 are Gregory Zuckerman’s “The Frackers: The Outrageous Inside Story of the New Billionaire Wildcatters”, Michael Lewis’ “The Big Short: Inside the Doomsday Machine”, and Richard McGregor’s “The Party: The Secret World of China’s Communist Rulers”.

The paper is divided into 4 sections. In the first section, a discussion of 3 ways of getting rich in a free market economy is provided. In section 2, a review of how the characters in “The Frackers” and “The Big Short” got rich is carried out. In part 3, the author will analyze some of the alternatives available to them with regards to becoming rich in the modern society. In the final section, the possibilities of economic success in Communist China are reviewed.

Three Ways of Creating Wealth in a Free Market Economy

There are several ways through which one may become rich in a liberalized economy. The first entails becoming a low cost producer in an increasing cost industry. The second one involves discovering a product that does not exist in the market. Thirdly, one may become wealthy by adjusting to the market (Trump and Mclver 34).

A low cost producer has high chances of becoming rich in today’s economy. The reason is that producing at low costs and selling at high prices leads to wide profit margins. Low cost investors must exploit economies of scale to implement their strategies of making money (Appleyard and Field 51).

They can achieve this by selling their products at low prices, but to the right market. In addition, they may opt to sell their products at the same price as their rivals. In spite of this, these producers will still sustain their profit margins. However, one requires sufficient capital to become a low cost producer (Appleyard and Field 53). +The capital is needed to attain significant economies of scale, which are needed to come up with a functional price advantage over competitors. Examples of low cost producers include the Canadian Natural Resources Limited and the Canadian Utilities Limited.

Discovering a new product is another strategy used by investors to create wealth. Coming up with an innovation that does not exist requires strategic and critical thinking (Trump and Mclver 43). One should look at all the dimensions related to the influence of the new product on the market.

The aim is to enhance its success and figure out how to deal with competitors who may arise in the future. The product should give customers something new and which they are craving for (Appleyard and Field 60).

When this happens, the invention is able to attract a large customer base. The clients may be drawn from the local or international market. In addition, an individual can buy stocks of a new company and start earning profits. Examples of people who have become rich as a result of coming up with inventions include Mark Zuckerberg and John Paul Dejoria. The latter is the creator of Paul Mitchell products.

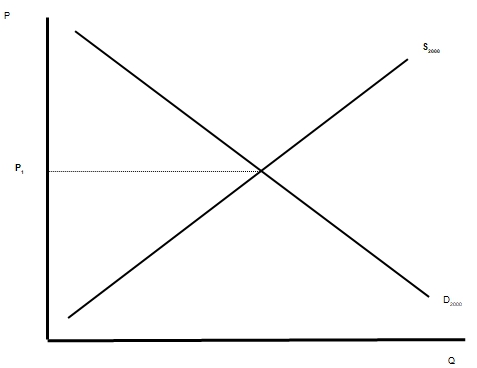

The third way of becoming wealthy involves adjusting to the market conditions. One can attain this by taking advantage of market disequilibrium. The situation arises when the price of a given product fails to match the supply (Chiarella 45). The case may be experienced momentarily.

As a result, one should know when to capitalize on the opportunity. The success of this strategy depends on various factors. They include availability of information pertaining to an increase or a decrease in demand, improvements and change in technology, and a decline in cost of inputs (Rittenberg and Tregarthen 40).

Getting Rich in the U.S from the Perspective of “The Frackers” and “The Big Short”

The two books give accounts of how a number of people got rich in the U.S within the past ten years. In “The Frackers”, Zuckerman illustrates how the individuals became wealthy by use of ‘direct means’. Zuckerman talks of six energy tycoons. They include Harold Hamm and Aubrey McClendon. Hamm is an oil and gas mogul, while Aubrey is the former Chief of Chesapeake Energy Crop. Zuckerman explains how the individuals became billionaires by operating companies that provided something new to the market.

They were more than determined to tap into the huge oil and gas deposits considered as waste (Zuckerman 45). They did this through such companies as Exxon and Chevron. The ‘wildcatters’ revolutionized the energy market by carrying out hydraulic fracturing experiments (Zuckerman 35).

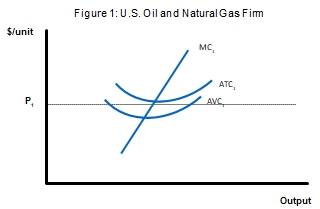

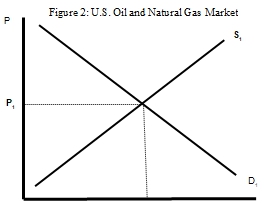

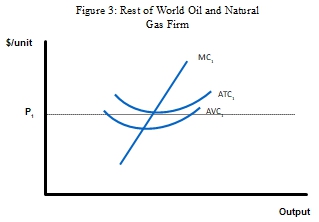

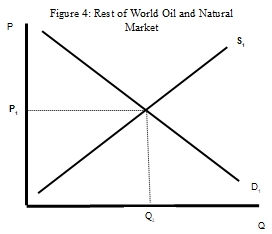

As a result, they were able to solve the problem of America’s over-reliance on imported energy. As illustrated in figures 1, 2, 3, and 4 below, the investors were able to identify the gap between the demand and supply of energy in the U.S. They filled the gap by coming up with a new product; fracking.

The book “The Big Short” explains how people became billionaires indirectly. The individuals took advantage of the 2007-2010 financial crises. They include Meredith Whitney, Steve Eisman, and Eugene Xu. The investors created the credit default swap market that opposed the Collateralized Debt Obligation bubble [CDO] (Lewis 32). They used logic to figure out that COD was going to collapse. They used the financial market to set themselves up.

Their strategy involved using a limited amount of money and taking advantage of leverage. A case in point is the founders of Cornwall Capital. They set up a hedge fund with $110,000 (Lewis 32). When the market crushed, they made over $120 million. Figure 5 below illustrates how the investors took advantage of the discrepancies between supply and demand in the money market.

The Frackers

An Ideal Way of Getting Rich in the U.S

There are various ways through which I can become wealthy in the U.S. As a 20 years old, the path to take is investing in new products. In today’s world, innovations are a significant way of generating wealth. The process involves coming up with creative ideas and building on them. To this end, I will come up with handmade prototypes.

Venturing into something new will allow me to explore all the possibilities of succeeding in the market (Dennis 69). I will come up with new software that can be used by both individuals and companies. With the proceeds, I will invest in a company that is developing a new product.

I will buy stocks before other investors when the merchandise is launched. When the new product hits the market, profits will grow. As a result, the price of the stocks will also rise. My course of action falls within the category of becoming rich by discovering a product that was not previously in the market.

Innovativeness and Wealth in Communist China

My course of action in part 3 above will have a high chance of succeeding in Communist China. Most people suggest that it is safer to invest in nations with democratic governments than in dictatorial regimes. The reason is that communist countries are a threat to foreign investors.

However, global money managers have a different opinion about China. The Chinese government promotes political order and stability (McGregor The Party: The Secret World 45). As a result, it provides investors with profit opportunities.

Another factor is that China has the fastest growing economy in the world. The main issue to consider is the new product’s effect on the Chinese community. The government has permitted foreign investors to produce and sell merchandise in the country (McGregor The Party: 1.3 Billion People 47).

Conclusion

Becoming wealthy involves making the right choices. The road to success is characterized by risks and phases of failure. However, an individual looking to invest as a way of achieving the intended goals should not be afraid of these setbacks. Success comes by working smart and capitalizing on the available opportunities. One should know when to make a move and implement the plans at hand.

Works Cited

Appleyard, Dennis, and Alfred Field. International Economics. 7th ed. 2010. New York: McGraw-Hill. Print.

Chiarella, Carl. Disequilibrium, Growth, and Labor Market Dynamics: Macro Perspectives, Berlin: Springer, 2000. Print.

Dennis, Felix. How to Get Rich, London: Ebury, 2006. Print.

Lewis, Michael. The Big Short: Inside the Doomsday Machine, New York: W.W. Norton, 2010. Print.

McGregor, Richard. The Party: 1.3 Billion People, 1 Secret Regime, London: Penguin, 2011. Print.

—. The Party: The Secret World of China’s Communist Rulers, London: Allen Lane, 2010. Print.

Rittenberg, Libby, and Timothy Tregarthen. Principles of Microeconomics, V. 2.0, London: Free Press, 2009. Print.

Trump, Donald, and Meredith McIver. Trump: How to Get Rich, New York: Random House, 2004. Print.

Zuckerman, Gregory. The Frackers: The Outrageous inside Story of the New Billionaire Wildcatters, London: Portfolio Penguin, 2013. Print.